Why you need more than a traditional pension fund?

For my entire life, I have been asking myself and questioning the unquestionable.

“Why would you go to work, have your employer give you another £5,000 per year, and then take that money and send it off into a pension fund, where you can’t touch it for 40 years?”.

The traditional route of going to work for 40 years, paying into a pension fund, buying a house and paying down your mortgage is a money trap that prevents people from ever having enough. In my opinion, the traditional pension fund is where you give your money away for 40 years hoping it matures. And, even if it does mature, I can guarantee you that following this route will leave you with an average lifestyle at best. For many, you will retire living a life of mediocracy, wishing you had done things differently but instead feeling trapped, along with a sense of regret and a total sense of nonfulfillment.

Right now, you may be thinking, ”who is this guy, and why should we listen to him, and has he achieved what he promotes?” Great questions and deserving of great answers. You need to listen to me, because I am talking from real-life experiences, from someone who has witnessed this frugal mindset his entire life and how it deceives, not liberates.

I grew up in a middle-class family, who followed the system and did all of the above. I was taught to live frugally, go to school, get good grades, and work my way up the corporate ladder, paying into a pension scheme. They told me I would eventually be able to afford my own home, and for the rest of my life, I should go to work and pay down my mortgage.

Well, here is your wake up call!

The £1,000,000 pension isn’t enough. That’s right; you heard that correctly, the £1,000,000 pension will leave you trapped.

Okay, you probably think, wow, seriously, this guy is a complete nutter. He doesn’t make sense. But what if you realised that this person, is authentic, transparent and can back up everything he is saying with real-life evidence. And before you discard my claims as empty internet rhetoric. I am not an internet fraudster trying to scam you of your hard earned money, and this is no scam, of that I assure you.

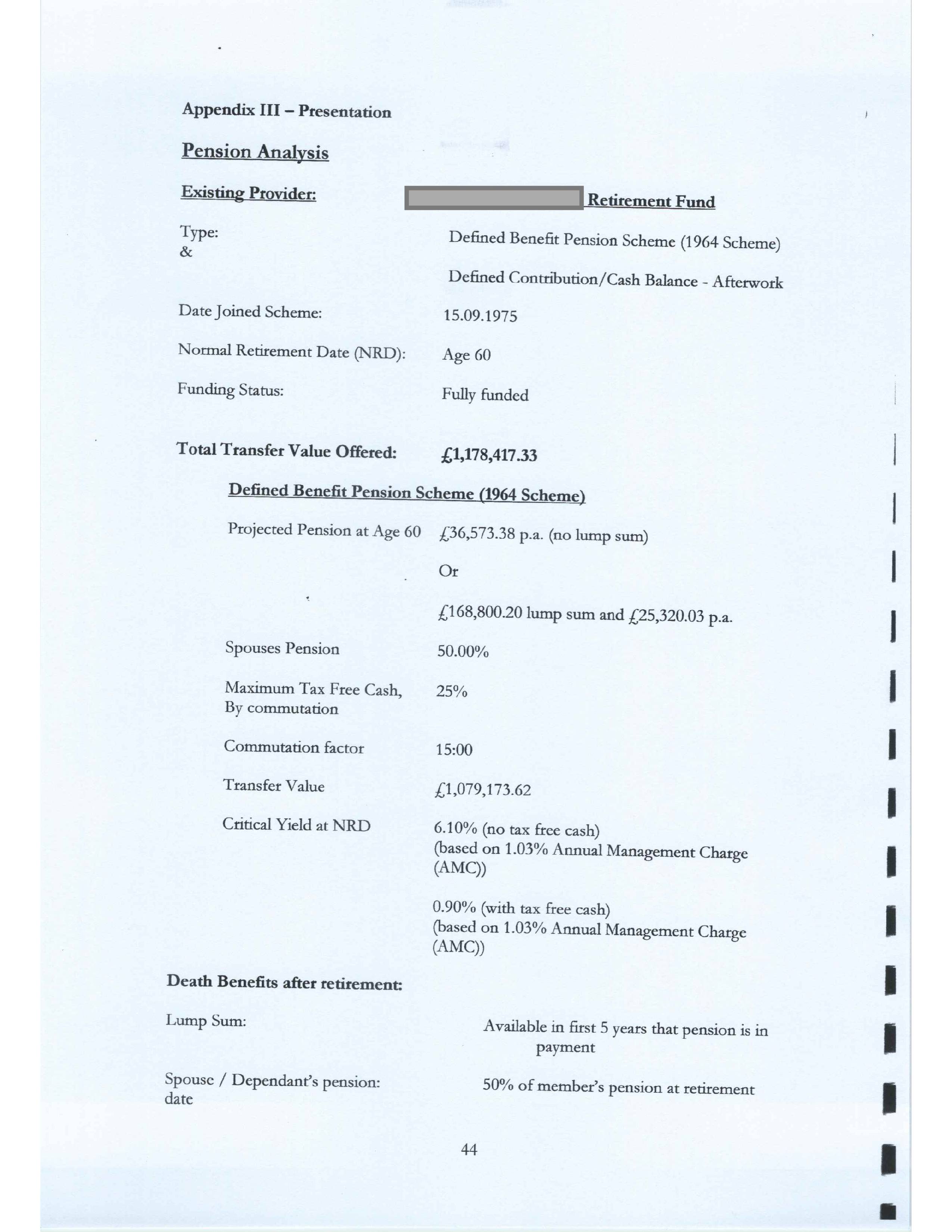

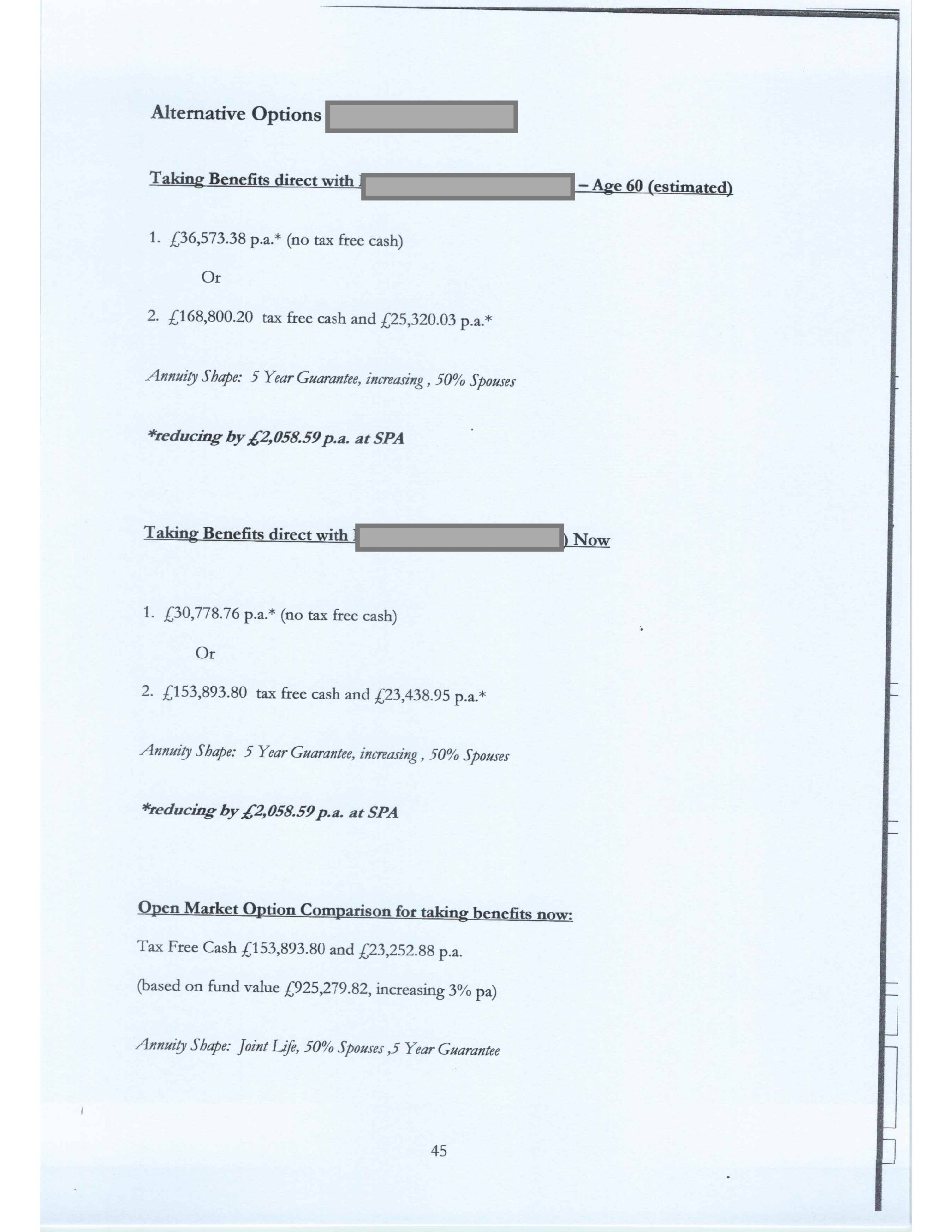

Here is my Dad’s £1,000,000 pension.

Forty-one years, three months following the system and working 80 hours a week for a national corporate bank, paying into a pension his entire life. A gross annual salary of £23,000 to £36,000 and a net income per month of £2,000 – £2,500.

Have I got you thinking yet?

According to the Office of National Statistics, the average salary in the UK for men and women combined was £29,009, which includes people in both full-time and part-time employment. For those in full-time employment, the average UK salary is £35,423.

So, you have probably already worked out using my Dad’s £1,000,000 pension that this pays an annual gross income of less than, and up to a maximum of the average UK salary.

Do you want to work for 41 years, and three months to get paid less than the average UK wage?

Most people invest in pensions to secure their financial freedom for later years in life. They have the mentality, that if I do this for 40 years, I will eventually be able to retire and have more time to do the things that I want to do. They think that they need to wait for 40 years to buy back their time. That is wrong, and far from the truth.

If all you ever do is pay into a pension fund, you will end up broke. And even when you do retire, yes, you will have your time back, but you won’t be able to afford to do the things that you want to do. So, what’s the point? Surely there is a better way?

The shocking truth here is that even if you do end up with a £1,000,000 pension fund, then you will be in the top 20% of people, classified as “pension millionaires” but closer to the truth, is the “millionaire’s pension scam”.

For most people reading this, they won’t even end up getting close to the £1,000,000 pension. Things must change if you want to secure your financial freedom.

Pension funds won’t help you get rich, and tying your money up for 40 years, is a bad move. You will not be able to invest in opportunities today, and if you know how to invest in property in the right way, you can make your money work so much harder, like 10 x harder. I would even go as far as to say 100 x harder, over 40 years, if you study financial literacy, and know how to buy good property deals that generate a good return on investment.

Money makes money, and you don’t need me to tell you that money sat in a pension fund that is inaccessible is a total waste of your financial resources.

Anyway, I am not a big name in the industry, so why bother listening to me? Well, I have an obsession with studying self-made millionaires, which started in my teenage years and I understand how and why they do what they do and how they achieve their phenomenal returns.

What I have found from my research is that many self-made millionaires, such as Grant Cardone and Steve Siebold, believe that rich people set their expectations high, and don’t have this way of traditional thinking.

Now, with that said, what I have done is built a £1,500,000 property portfolio inside of 18 months, comprising of 15 properties that generate a net passive income of £72,000 per annum and a gross rental income of £156,000 per annum, based on 100% occupancy rates. So, I am starting to believe in my ability, and trust my way of thinking, that property as a pension is a much better way of using your money.

In our first four property deals, which we bought inside of 6 months, the income generated from our property investments was almost double the annual income of my Dad’s £1,000,000 pension.

Look if you have access to some capital or you have a tax-free lump sum to withdraw from your pension or equity sitting in your home doing nothing, the sensible thing to do is to educate yourselves, so that you can make solid financial decisions to secure your future.

When you educate yourself and have the expert knowledge, I can teach you, you will arrive at the same conclusions as to the wealthiest people in the world. And yes, it is that simple.

The single best decision that I have ever made in my entire life has been to invest in myself. If I had the same mindset as the masses, I wouldn’t be empowering you right now, and giving you an insight into my family’s painful lessons.

I would be making the same mistakes and stuck in a job that I hated, paying into a pension where my money is not working for me as it should. I wouldn’t have the freedom and choice that I have today to follow my passion and live the life of my dreams.

The value of investing in yourself is much higher than in investing in stuff you know little about. Legendary investor and public speaker Jim Rohn said – Invest in a job, and you make a living, but invest in yourself, and you can make a fortune.

It’s time for a much-needed mindset upgrade. Rather than focussing on saving, you must focus on earning, by making your money work for you, not against you.

In summary; Think carefully of what it is you are trying to achieve. What does your big picture look like? Can you visualise a successful conclusion and a favoured outcome?

When you think short term, like my Dad, you will end up in the same situation.

There is a better and far more profitable option. Rich people put their money into profitable investments and for most this includes solid property deals that return quality passive income coupled with long term capital growth. They don’t invest it into employer pension funds who hope you will never figure out what I am teaching you.

Bottom line; Want to multiply your money and learn how to make it work hard for you, with predictability, confidence and complete certainty.

JOIN me on my next LIVE online Masterclass. Follow the link below NOW!

How To Start & Grow A “Hyper-Profitable” Property Business

On this online masterclass, Richard shares with you exactly how he went from feeling unfulfilled in his corporate job where he was stuck trading his time for money to building a multi-million property portfolio and replacing his original salary whilst freeing up time to live life on his terms.